Pig farming is a key livestock sector, USD worth about 20 billion, accounting for over 62% of the total output of fresh meat of all kinds in our country. From the fragmented, small-scale, self-sufficient livestock farming in the past, in 2023, the pig farming industry of Vietnam was ranked 5th in terms of head and 6th in terms of meat output.

New opportunities mixed with challenges

According to Mr. Pham Kim Dang, Deputy Director of the Department of Livestock Production, the pig farming currently is in some advantages, specifically: Legal documents, technical standards, mechanisms, policies and projects... to organize management, develop livestock farming in general and pig farming in particular are increasingly complete, synchronous and unified.

Vietnam's pig farming industry has a large domestic market with over 100 million people, number of international tourists is increasing due to tourism, cultural activities, and festivals being reorganized after the Covid-19 pandemic. In particular, the pork is a favorite food and one of the main foods are used daily by Vietnamese people.

The investment amount in the livestock farming industry is increasing as more and more large Vietnamese enterprises, foreign enterprises and other economic sectors invest in developing and processing livestock products according to the farm to table chain model.

From March 2023, the price of animal feed began to decrease, leading to a decrease in the cost of raising pigs compared to the first months of 2023, the price of live pigs increased from February 2024 (from 55,000-75,000 VND/kg), helping the farmers and businesses make a profit.

Pig farming has quickly absorbed scientific and technological advances in both breeds and equipment, taking science and technology as the driving force for development, an important production force to increase productivity and reduce production costs.

Besides, the Government issued the Decree No. 106/2024/ND-CP dated August 1, 2024, stipulating support policies to improve livestock farming efficiency as a basis to encourage the localities, businesses and farmers to have the opportunity to access investment support sources in livestock development in general and pig farming in particular.

Mr. Pham Kim Dang also said that the pig farming still faces difficulties such as: biosafety farming and disease control have not been implemented synchronously; professionalism in farming of small and medium-sized households and farms has not been improved; production costs are still high; centralized and industrial slaughter cannot compete with small-scale slaughter, leading to a large difference between the selling prices of farmers; the pig farming still depends heavily on imported inputs such as high-quality breeds and especially animal feed ingredients; globalization of the market has a great impact on supply chains and the competition for livestock products is increasingly tense...

Diseases are still the top concern for Vietnam's pig farming industry; according to Mr. Phan Quang Minh, Deputy Director of the Department of Animal Health, from the beginning of the year to August 12, 2024, the whole country had 863 African Swine Fever (ASF) outbreaks in 46 provinces and cities; the total number of pigs infected, dead and destroyed was more than 57,000. The whole country had 3 outbreaks of foot-and-mouth disease type O in pigs (86 infected pigs, 43 died and destroyed pigs). In addition, the system of livestock and veterinary management agencies in localities is facing many disruptions, causing difficulties and inadequacies in operations.

Strong structure shift.

After incidents in the livestock farming industry such as ASF and the Covid-19 pandemic occur, pig farming has shifted sharply towards the trend of reducing small-scale livestock farming households and increasing professional livestock farming households and large-scale farms. In the past 5 years, the rate of household farming has decreased by 5-7%/year, and in 2019-2022, small-scale livestock farming households decreased by 15-20%. Currently, the output of pigs produced by small-scale households decreases to 35-40%; the output of pigs produced by professional households and farms accounts for 60-65%.

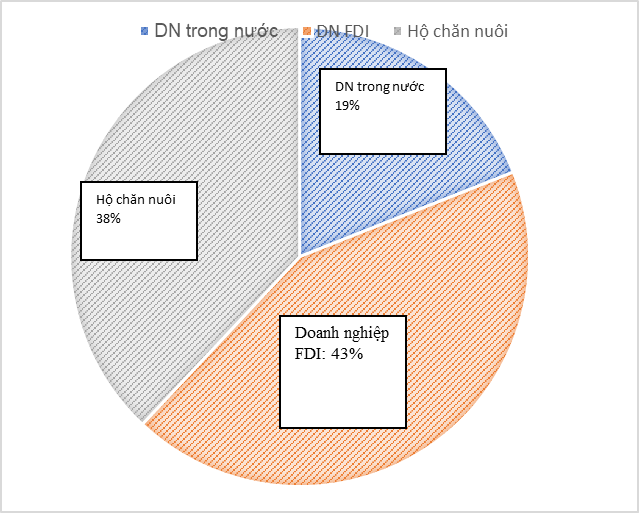

The structure of pork supply in 2022 and 2023 shows that domestic enterprises only account for about 19%, livestock farming households account for 38%, and FDI enterprises account for 43% (according to a report by Vietcombank Securities - VCBS).

Large domestic livestock farming enterprises such as Dabaco, Masan, Tan Long, Thien Thuan Tuong, Mavin, GREENFEED, Truong Hai, Hoa Phat and Xuan Thien... and foreign enterprises such as C.P Vietnam, Japfa Comfeed, New Hope, CJ Vina and Thai Viet... are building and gradually forming a chain linkage system (feed-farm-food), distribution and retail systems to reach the consumers at the best prices. This is the step of shifting the livestock structure to gradually modernize the livestock farming industry.

Structure of pork supply in Vietnam's livestock farming in 2022-2023 (Vietcombank Securities - VCBS)

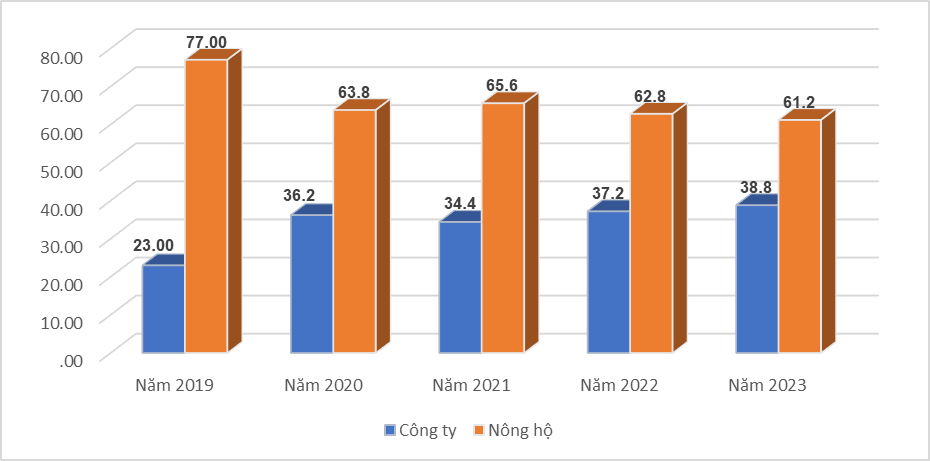

Structure of sow herds between the livestock farming enterprise sector and the livestock farming household sector is gradually changing; the proportion of sow herds in the later sector tends to decrease, while that of the first sector is increasing. Specifically, in 2022, the breeding sow herd was estimated at 3.03 million, an increase of 8% compared to 2021. Compared to 2016 (the year the sow herd peaked at 3.6 million), the size of the sow herds of the enterprises has expanded more than double. Of which, the livestock farming enterprise sector contributes 37.2% of the total sow herd, but due to the high reproductive efficiency of sows and better housing conditions, this sector contributes 47% of the total number of pigs for sale in 2022 (equivalent to 19 million pigs compared to the total of 41 million pigs for sale, an increase of more than 18% compared to 2021).

In 2023, total breeding sow herd reached 3.12 million, an increase of 2.9% compared to 2022. Of which, the sow herd of enterprises was 1.21 million, accounting for 38.8% of the total sow herd nationwide, while the sow herd in households was 1.91 million, accounting for 61.2% of the total sow herd nationwide.

Structure of Vietnam's sow herd is distributed by livestock farming

households and enterprises (Unit: % - source: AgroMonitor)

According to Mr. Pham Kim Dang, the small-scale livestock farming will not be completely lost, because it is the livelihood that has been formed for generations by millions of livestock farming households. However, the small-scale farmers who want to survive must unite to increase their strength to become members of groups, cooperatives, or associate with businesses. If they want to survive independently, they must raise livestock professionally or raise rare, valuable specialties, organic and ecological livestock associated with tourism.

Livestock market changes

As said by an expert in the livestock farming industry, the household and small-scale farming is a weak link, so it is most vulnerable with the rapid decrease rate. That is inevitable in the livestock farming industry, but the small-scale livestock sector is decreasing faster than we expected. This is unusual and thinking about it must be noted and it also reflects that household farming is being overwhelmed by the industrial farming, especially FDI. Changing the structure of farming will rearrange the order and market of farming. This also shows the advantage of large-scale farming and high-tech farming in terms of productivity and cost.

The market share of the pig farming industry is dominated by enterprises and farms which also causes the accompanying industries such as animal feed, veterinary medicine and auxiliary equipment, etc. to change and are restructuring very strongly, investing more systematically and professionally in both production and services.

Animal feed manufacturing companies/enterprises are also gradually shifting from the dealer channel to focusing on selling large farms and developing farm systems for self-raising purpose. Pharmaceutical and vaccine companies must also shift accordingly; a small-scale dealer channel is reduced; number of farm customers and large corporate customers is increased, leading to a reduction in purely business personnel, increasing highly qualified technical personnel to support and advise the customers on solutions.

The demand for technical personnel in farms of companies and groups is very large and requires high expertise, professionalism and experience in operating and producing large-scale farms. In addition, the group of livestock worker personnel directly involved and accounting for >90% of the farms are also in serious shortage, very difficult to recruit and do not stay long-term.

In addition, the livestock farming industry has be seen the formation and operation of many livestock projects with a scale of 10,000 sows, tens of thousands of pigs... etc. which are concentrated in some provinces with large land funds such as the Central Highlands, Northern Midlands and Mountains, North Central... Super-large-scale farms are the optimal solution in management and investment but will be a challenge when ASF and environmental consequences occur. It is time for the pig farming industry of Vietnam to have breakthrough changes in both infrastructure, superstructure and relevant personnel.

(Source: Vietnam Livestock Magazine)